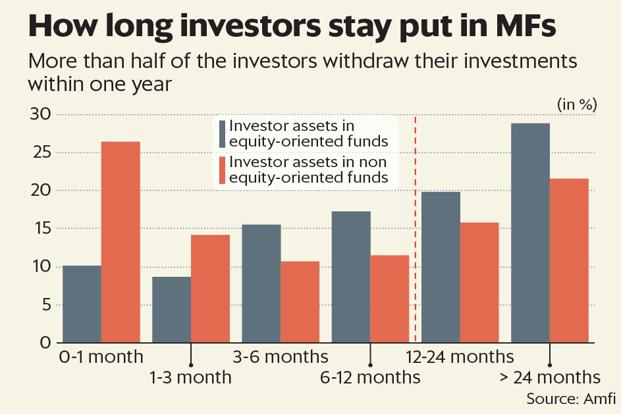

Although more investors are putting their money in mutual funds (MFs) through systematic investment plans (SIPs), they are not necessarily staying invested for the long term. Data from the Association of Mutual Funds of India (Amfi), the MF industry’s trade body, shows that just 29% of equity assets stay invested for more than two years. A huge 51% of equity assets get withdrawn before a year gets over.

The Indian mutual fund industry may be boasting about increased SIP inflows over these past two years, but if investors don’t stay invested for the long-term, have they really benefited?

The prospect of an economic turnaround and a sustained ‘Mutual Funds Sahi Hai’ campaign by the Indian MF industry in the past two years have resulted in more investors coming to MFs. The note ban of 2016 also resulted in an increased financialisation of savings wherein investors shifted from real estate and gold investments to MFs. Falling bank fixed deposit rates at the time also nudged investors to move and invest in MFs, particularly balanced funds and in some cases, debt funds.

From getting around ₹3,122 crore every month through the SIP route in April 2016, a little more than ₹7,500 crore poured into equity funds in July 2018, as per Amfi data. The number of investor accounts have gone up from 47.7 million to 74.6 million in the same period. To be sure, an investor may open more than one account in a single fund or across funds; so the increase in the number of investor accounts may not necessarily indicate an increase in the number of investors.

“Traditionally, investors have been used to investing in one-year FDs. That explains why so many investors withdraw from MFs within a year. But if you look deeper in the number of investors who do stay invested beyond two years, some of them would stay for a really long time,” said Chandresh Nigam, managing director and chief executive officer, Axis Asset Management Co. Ltd.

But surely, rising equity markets would tempt investors to stay on for a little longer given the potential gains they are likely to make? “On the contrary, many investors tend to churn more in rising markets. When their funds don’t go up as much as some other funds, very quickly they get a feeling of being left out. This has been especially so in the past year when many large-cap funds underperformed the equity markets. Equity markets have gone up, but the reality is that very few stocks have pulled the markets up. A broad section of stocks have underperformed actually, and that has also resulted in many equity funds underperforming,” said Tarun Birani, founder and CEO, TBNG Capital Advisors.

What is the ideal holding period?

Experts recommend investors to hold on to their equity MFs for a time period of at least five years. A Mint-Crisil Research study on the effectiveness of SIPs published in November 2017 pointed out that if you stayed invested for shorter time periods such as 1-4 years, your chances of making losses are higher. The study pointed out SIPs that run for at least seven years or more have bare minimum to no chance of making a loss .

“Too many investors have come into MFs—presumably for the first time ever—in these past two to three years based on recent past performances. They expect to make similar returns over the next 2-3 years. But that is a wrong approach. A majority of investors invest haphazardly and without planning for any financial goals. Then, if they don’t get a good experience, they exit,” said Mrin Agarwal, a financial educator, founder director of Finsafe India Pvt. Ltd and co-founder of Womantra.

One way to develop patience, said Agarwal, is to invest keeping financial goals in mind.

If the goals are long term, then you need to check periodically, at best once or twice a year, as to how close you are getting to your goal. If you are on path, then it doesn’t matter whether your fund gives 15% return as opposed to some other fund that has given, say, 20% return.