After hitting a record high in January 2020, Indian equity benchmarks crashed 40 percent to hit around four-year low level on March 24. The indices have recovered since then on the back of liquidity (by global central banks) and gradual re-opening of economies despite virus risk.

The BSE Sensex and Nifty50 as well as Midcap and Smallcap indices plunged 29 percent each during the March quarter. Sectoral indices also witnessed double-digit decline.

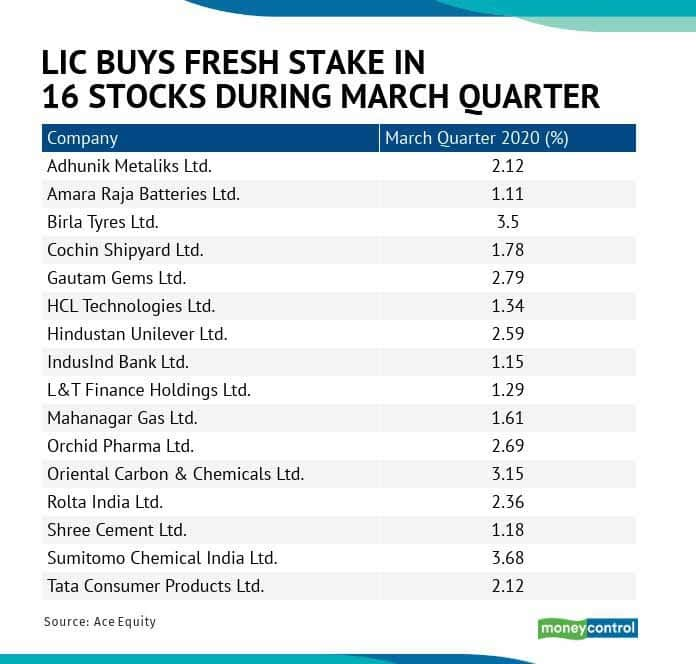

Life Insurance Corporation of India (LIC), one of the major equity investors, made fresh investments in 16 stocks during the March quarter.

"LIC acted well using the COVID adversity and creating opportunity out of it due to availability of quality stocks at rock bottom prices and attractive valuations as well as huge amount of liquidity, which comes through renewal premiums as March is usually one of the best months in terms of premium collections and policy sold which is deployed using the fall as an opportunity," Prashanth Tapse, AVP Research at Mehta Equities told Moneycontrol.

These 16 stocks included HCL Technologies, Hindustan Unilever, IndusInd Bank, Adhunik Metaliks, Amara Raja Batteries, Birla Tyres and Tata Consumer Products.

Table: Stock holding (in %) of LIC in stocks in March quarter

"March quarter has witnessed some of the most volatile and devastating stock movements, unseen in years since 2008. Seeing this as an opportunity hidden in crisis, LIC has acquired stake in some value picks. Some of these include Amara Raja Batteries, HCL Technologies, Hindustan Unilever, Mahanagar Gas etc. These fresh acquisitions should be seen as a result of PRICE coming below the VALUE in the quality stocks which have potential to grow in mid and long term," Gaurav Garg said.

Furthermore, as of December quarter there were more than 350 stocks on the LIC's radar and in March quarter, it held stake in 326 stocks.

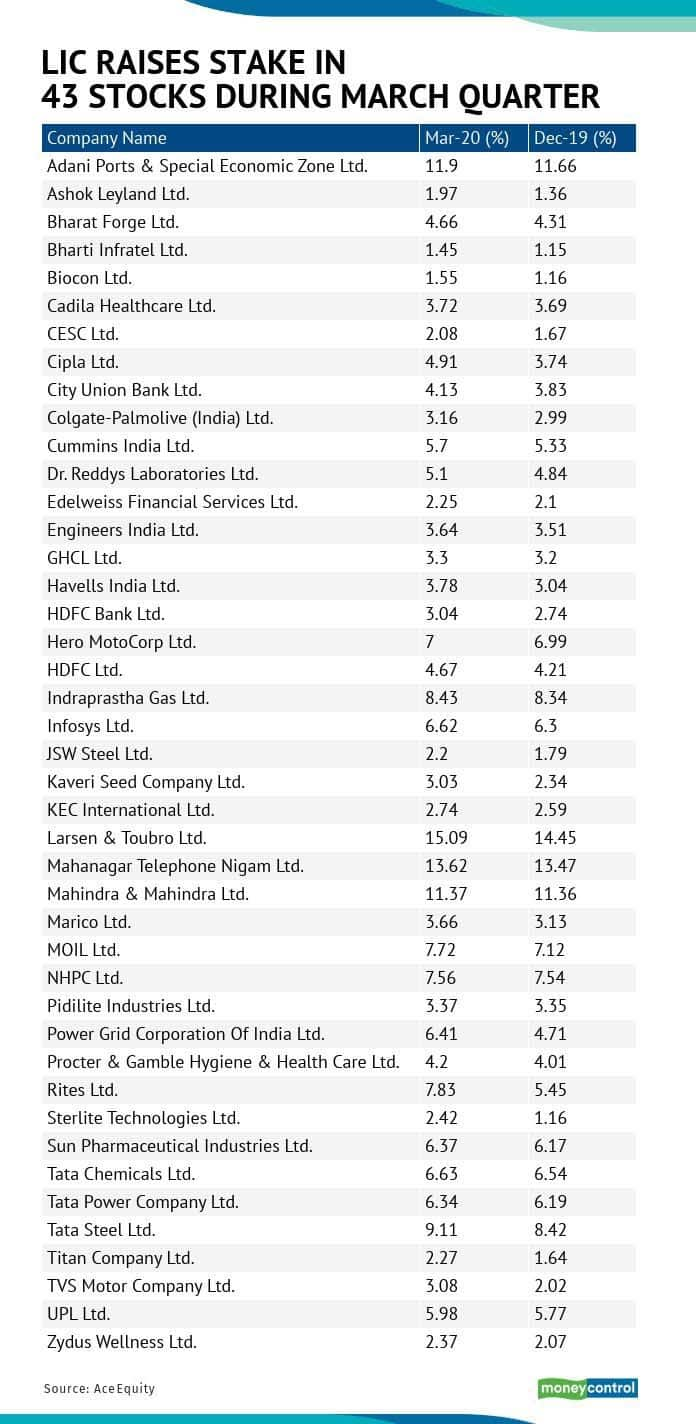

The state-owned insurance major bought additional stake in 43 stocks during the quarter, taking the opportunity of sharp fall in prices.

"LIC is one of the major equity investors in India and has been known for its quality picks. It had been on a shopping spree in the quarter ending March since the Coronavirus pandemic and its aftermath has resulted in deep discounts on a number of quality stocks," Gaurav Garg, Head of Research, CapitalVia Global Research Limited- Investment Advisor told Moneycontrol.

Stocks where LIC acquired additional shareholding were Adani Ports, Ashok Leyland, Bharat Forge, Bharti Infratel, Biocon, Colgate, Cummins, Dr Reddy's Labs, Havells and HDFC Bank.

"The stake has been increased in 43 Companies across different sectors which are expected to see growth in the short term. Some of these are related to pharma sectors; some in FMCG and consumer durables, and many others in the energy and construction sector. This stake increase in these stocks can be attributed to the averaging opportunity in quality stocks since these stocks were available at a steep discount without much change in their fundamentals," Gaurav Garg said.

Prashanth Tapse said larger institutions usually accumulate blue chip companies in panic scenarios which have greater ability to withstand the slowdown pressure because well managed & stronger balance sheets and also give comforts in investing in this uncertain environment as leaders expected to lead the recovery in the growing economy, as and when things start to normalise.

Stocks where LIC pared stake

LIC during the quarter reduced its shareholding in 81 stocks, which included ACC, Ambuja Cements, Asian Paints, Axis Bank, Bajaj Auto, Bajaj Finserv, Bata India, Bharat Electronics, BHEL, BPCL, Bharti Airtel, Britannia Industries, CONCOR, Dabur India, Garden Reach Shipbuilders, GSK Pharma, HEG, Hindalco, Yes Bank, ICICI Bank, ITC, ICRA, Kotak Mahindra Bank, Maruti Suzuki India etc.

The insurance company exited 47 stocks in quarter ended March 2020 and many of them were either smallcaps or penny stocks, while LIC's shareholding in 186 stocks during March quarter remained unchanged compared to December quarter.